M2 Growth Plummets Down To Zero

EDITOR'S NOTE: It’s interesting to see common optimism floating around on Wall Street as mainstream financial media often represents it. It certainly makes you wonder if this is truly the case, as any investor, from retail to professional, can simply look “under the hood” of the economy. Detractors would claim that in 2020, Fed Chair Jerome Powell fell asleep at the “printer switch,” as the central bank’s virtual printing machines created more dollars than it ever had in decades past. Runaway inflation was the outcome, largely attributable to the Fed. Now, Powell may have fallen asleep again, as the M2 money supply growth—measuring all money in circulation including check deposits, savings deposits (less than $100,000), and money market mutual funds—have fallen to ZERO. This has never happened before. So, what’s the outcome going to be this time? Read on to get a full analysis of what’s going on and what it implies for the near future.

Summary

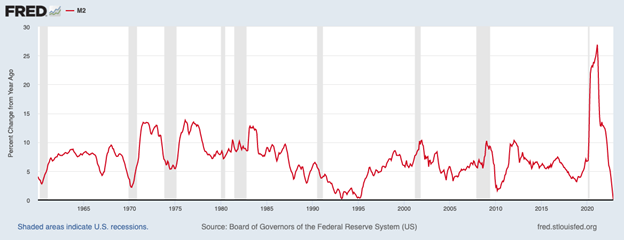

- The growth in M2 money supply just went to zero. It has never done that – with the data going back to 1960. It has been below 1% in 1993 and 1995, but never to zero.

- Basically, the Federal Reserve is choking off the creation of credit in the economy with their actions, which is flattening out money supply growth.

- As they have stated, they have to slow the economy down in order to balance supply and demand.

Source: Seeking Alpha

Once I had a truly bizarre conversation with a financial journalist at a major organization. His jaw-dropping point was that the Fed does not control the money supply. Actually, it does, but try arguing that with a person that does not understand the mechanics of the Fed. It did help later on that in 2020 Jerome Powell went on 60 Minutes and stated that the Fed controls the money supply.

In a now infamous quote, Powell told 60 Minutes, “We print it digitally.”

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

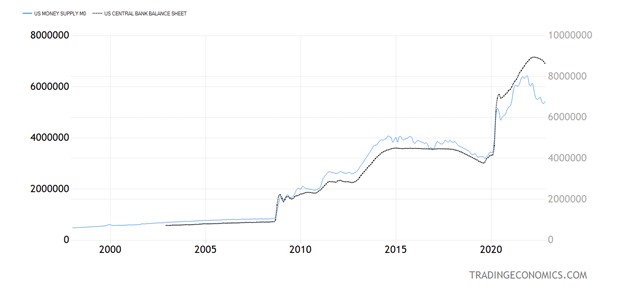

By this admission, we know that the Federal Reserve directly controls the growth and now shrinkage of its balance sheet. The monetary base is the narrowest form of money supply (called M0, or M-zero) that is directly controlled by the Fed. That’s currency in circulation and excess reserves at the Fed that happen via QE – the money from which the infamous “We print it digitally,” comes from.

There are other forms of money supply, ranging from M1 to M2 and M3 (which is no longer reported but is possible to reconstitute with raw data from the Fed). The broader the form of the money supply (the higher the “M” number), the less directly the Fed controls it, but it does affect its direction. A surge in M2 can happen because of what the Fed is doing as well as a collapse in M2, which is happening at present.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The growth in M2 money supply just went to zero. It has never done that – with the data going back to 1960. It has been below 1% in 1993 and 1995, but never to zero.

The Federal Reserve Bank of St. Louis says, “M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.”

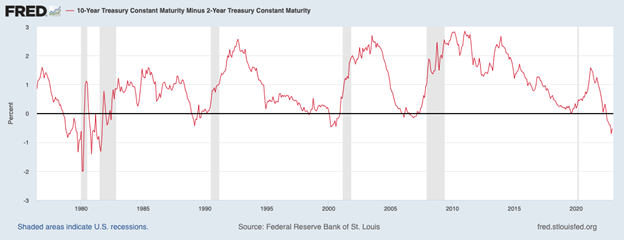

In an inverted yield curve situation, directly created by the Fed, short-term rates are above long-term rates, which makes it more difficult for the financial system to produce credit growth as the time tested “borrow short, lend long” mantra of the banking system does not work very well.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Basically, the Federal Reserve is choking off the creation of credit in the economy with their actions, which is flattening out money supply growth. As they have stated, they have to slow the economy down in order to balance supply and demand. The former President of the Federal Reserve bank of New York, Bill Dudley, thinks a recession is inevitable and has stated so on multiple occasions since last summer.

Jan Hatzius, now Goldman’s chief economist, thinks the chances of recession in 2023 are near 35%. Jan Hatzius took over Bill Dudley’s job at Goldman Sachs. It is fair to say that some very smart people have highly divergent views when it comes to the economy in 2023.

I think Jerome Powell messed it up pretty good in 2021 by falling asleep at the switch with his peddling of the “transitory” myth, and then he compounded the problem by keeping QE running until March 2022. The top in the Fed balance sheet came on April 13, 2022, at $8,965,487 million, or just shy of $9 trillion.

It is not only Powell’s fault we have inflation. It is also out-of-control Covid deficit spending by Congress and two administrations that the Fed monetized. We spent as much money on COVID as we did in WW2 (as a percentage of the economy), only in WW2 it took five years to spend and in 2020 it took one! If that kind of out-of-control spending does not create inflation, I don’t know what will.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Originally published by Ivan Martchev at Seeking Alpha

sign up for the newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.